401k Tax Deduction Limit 2024

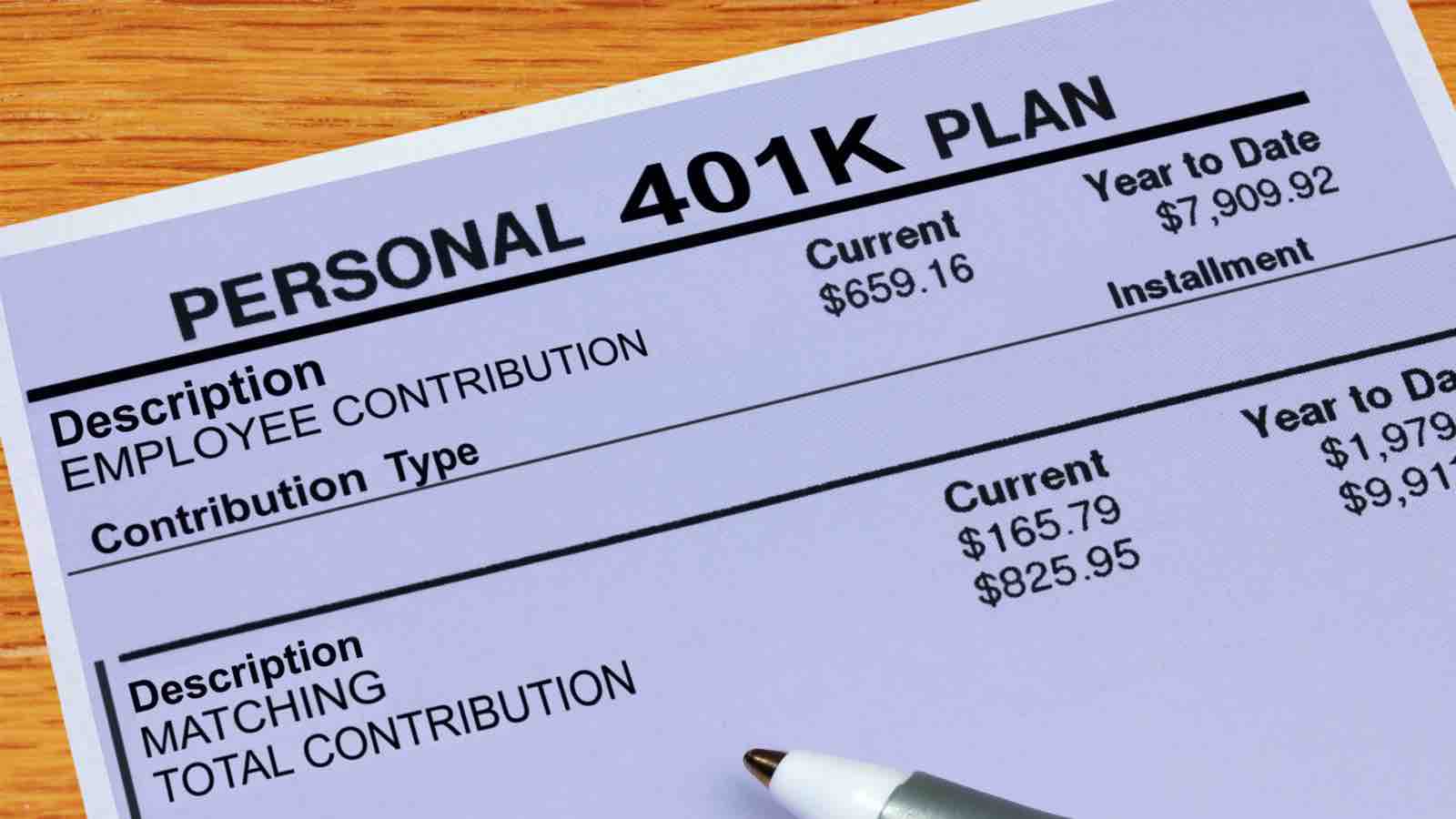

401k Tax Deduction Limit 2024. For 2024, the irs limits the amount of compensation eligible for 401(k) contributions to $345,000. The combined limit for employee and employer contributions is $69,000 in 2024, up from $66,000 in 2023.

The standard deduction for 2024 is $14,600 for individuals or $29,200 for married couples filing jointly. There is no need to track or manually deduct your 401 (k) contribution from your annual wages.

As Of 2023, Individual Employees Have A 401 (K) Contribution Limit Of $22,500, Allowing Them To Contribute This Amount Annually To Their 401 (K) Account On A.

For 2024, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

Participants Who Are 50+ Can Save An Additional $7,500 In.

This amount is up modestly from 2023, when the individual 401.

Those Aged 50 And Above Can Contribute An Additional $7,500.

Images References :

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png) Source: keskustelu.kauppalehti.fi

Source: keskustelu.kauppalehti.fi

Treidaus 2023 Sivu 318 Kauppalehden keskustelupalsta, Income tax brackets have been updated for 2024, affecting taxpayers at different income levels. As of 2023, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a.

Source: rositawcarena.pages.dev

Source: rositawcarena.pages.dev

Federal 401k Contribution Limit 2024 Gaby Pansie, 401(k) contribution limit for 2024. The 401(k) contribution limit for 2024 is $23,000.

Source: www.insuranceneighbor.com

Source: www.insuranceneighbor.com

What Happens If I Stop Adding To My 401(k)? Insurance Neighbor, If yes, you could contribute $9300 for the year ($6800 additional). Those aged 50 and above can contribute an additional $7,500.

Source: uglybudget.com

Source: uglybudget.com

How The SECURE Act Changes Your Retirement Planning The Ugly Budget, This is the max amount of money you can put into your 401k plan each year. You can contribute to more than one 401(k) plan.

Source: sheetsforinvestors.com

Source: sheetsforinvestors.com

Free 401(k) Calculator Google Sheets and Excel Template, If you're under 50, you can contribute up to $23,000 in 2024. The ira catch‑up contribution limit for individuals aged 50.

Source: www.mysolo401k.net

Source: www.mysolo401k.net

Compare tax deduction vs tax credit for solo 401k My Solo 401k Financial, In 2024, the 401(k) contribution limit for participants is increasing to $23,000, up from $22,500 in 2023. There are also income limits above which you can’t contribute this full amount.

Source: isabellewaddy.pages.dev

Source: isabellewaddy.pages.dev

2024 Max Employee 401k Contribution Cari Marsha, The ira catch‑up contribution limit for individuals aged 50. If you had no other taxable income, a couple could.

Source: aubreeqnatasha.pages.dev

Source: aubreeqnatasha.pages.dev

401k Annual Limit 2024 Reeva Celestyn, The standard deduction for 2024 is $14,600 for individuals or. People 50 and over can contribute an extra $7,500 to their 401 (k) plan in 2023 and 2024.

Source: choosegoldira.com

Source: choosegoldira.com

401k 2022 contribution limit chart Choosing Your Gold IRA, This amount is an increase of. There are also income limits above which you can’t contribute this full amount.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, The ira catch‑up contribution limit for individuals aged 50. If it is not an hdhp and you switch to your spouse' insurance effective august 1, then your hsa.

The Contribution Limit For 401 (K)S, 403 (B)S, Most 457 Plans And The Federal Government's Thrift Savings Plan Is $23,000 For.

Income tax brackets have been updated for 2024, affecting taxpayers at different income levels.

401K Tax Deduction Limit 2024.

The 2024 401 (k) contribution limit.